Financially Supporting Individuals and Households through COVID-19

The Australian Government is providing financial assistance to Australians. This assistance includes income support payments, payments to support households and temporary early releases of superannuation.

-

- Income support for individuals

- Payments to support households

- Temporary early release of superannuation

- Temporarily reducing superannuation minimum draw-down rates

- Reducing social security deeming rates

INCOME SUPPORT FOR INDIVIDUALS

Over the next six months, the Government is temporarily expanding eligibility to income support payments and establishing a new, time‐limited Coronavirus supplement to be paid at a rate of $550 per fortnight.

Eligibility Payment categories

The income support payment categories eligible to receive the Coronavirus supplement are:

- Jobseeker Payment1 (and all payments progressively transitioning to JobSeeker Payment; those currently receiving Partner Allowance, Widow Allowance, Sickness Allowance and Wife Pension)

- Youth Allowance Jobseeker

- Parenting Payment (Partnered and Single)

- Farm Household Allowance

- Special Benefit recipients Anyone who is eligible for the Coronavirus supplement will receive the full rate of the supplement of $550 per fortnight

PAYMENTS TO SUPPORT HOUSEHOLDS

The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders. The first payment will be made from 31 March 2020 and the second payment will be made from 13 July 2020.

Around half of those that benefit are pensioners. This payment will help to support confidence and domestic demand in the economy. The second payment will not be made to those eligible for the Coronavirus supplement.

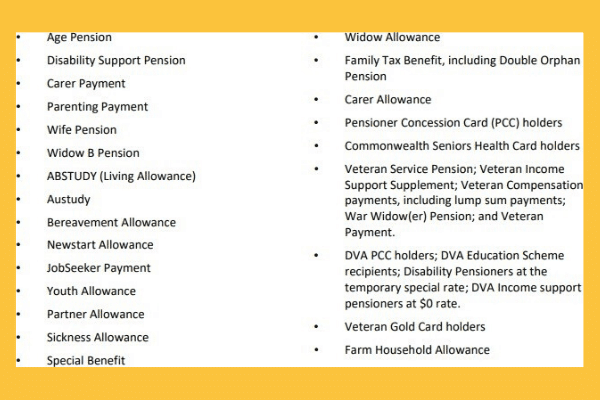

Eligibility for the first and second payment

To be eligible for the first payment, you must be residing in Australia and be receiving one of the following payments, or hold one of the following concession cards, at any time from 12 March 2020 to 13 April 2020.

To be eligible for the second payment, you must be residing in Australia and be receiving one of the payments or holding one of the concession cards that were eligible for the first payment, JobSeeker, Youth Allowance JobSeeker, Parenting payments, Farm Household Allowance, Special Benefit.

TEMPORARY EARLY RELEASE OF SUPERANNUATION

The Government is allowing individuals affected by the Coronavirus to access up to $10,000 of their superannuation in 2019‐20 and a further $10,000 in 2020‐21. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Eligibility To apply for early release you must satisfy any one or more of the following requirements:

-

- You are unemployed; or

- You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- On or after 1 January 2020: you were made redundant; or your working hours were reduced by 20 per cent or more; or if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 per cent or

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

TEMPORARILY REDUCING SUPERANNUATION MINIMUM DRAWDOWN RATES

The Government is temporarily reducing superannuation minimum draw-down requirements for account‐based pensions and similar products by 50 per cent for 2019‐20 and 2020‐21. This measure will benefit retirees holding these products by reducing the need to sell investment assets to fund minimum draw-down requirements.

Temporary Reduction in Superannuation Minimum Draw-Down Requirements

This measure will benefit retirees with account‐based pensions and similar products by reducing the need to sell investment assets to fund minimum draw-down requirements.

The reduction applies for the 2019‐20 and 2020‐21 income years

This measure will have no impact on the underlying cash balance for 2019‐20 and a negligible impact in 2020‐21.

REDUCING SOCIAL SECURITY DEEMING RATES

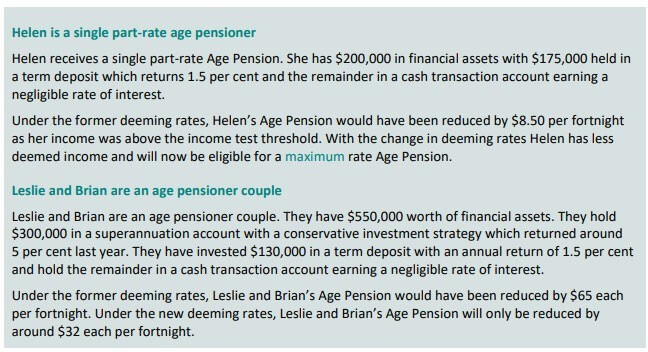

On 12 March, the Government announced a 0.5 percentage point reduction in both the upper and lower social security deeming rates. The Government will now reduce these rates by another 0.25 percentage points.

As of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. The reductions reflect the low interest rate environment and its impact on the income from savings.

The change will benefit around 900,000 income support recipients, including around 565,000 Age Pensioners who will, on average receive around $105 more of the Age Pension in the first full year the reduced rates apply.

How can Wealthy Self help?

During these challenging times, it is important that we keep the lines of communication open. If at any time you wish to discuss your financial circumstances or personally believe that you may need some assistance with your personal situation but really don’t know where to start, please contact David.

We may not have all the answers but we will do everything we can to help you in any way that we can.

From our family to yours, stay safe.

Director, Founder & Principal Adviser

Content courtesy of https://treasury.gov.au/coronavirus/households dated 23 March 2020.

General Advice Disclaimer

This blog contains general advice only. You need to consider with your financial planner, your investment objectives, financial situation and your particular needs prior to making any strategy or product decision. InterPrac Financial Planning Pty Ltd and its authorised representatives do not accept any liability for any errors or omissions of information supplied in this document except for liability under statute which cannot be excluded.